Thursday, August 8, 2019

|>> Forexlive Americas **FX news wrap: A wild day in the markets**

|>> Forexlive Americas **FX news wrap: A wild day in the markets**

Forex news for NY trading on August 7, 2019

- US broad indices end a wild day with major comeback

- Attn NZD traders - RBNZ Governor Orr speaking real soon, at 2010 GMT

- Saudi's considering all options to halt oil drop

- US consumer credit for June $14.596 billion versus $16.1 billion estimate

- US WTI crude oil futures settle at $51.09

- Fox's Edward Lawrence: China expects tariffs will go to 25%

- Gold wanders lower after double top....$1500 and intraday moving average support eyed.

- Secretary of State Pompeo: Hopeful talks with North Korea will resume

- US treasury auctions $27 billion of 10 year notes at 1.670%

- Japan eases some export restrictions to South Korea

- China's Global Times: China and US are caught in a stalemate worse than round one

- Fed's Evan: Economic headwinds mean cutting rates further could be reasonable

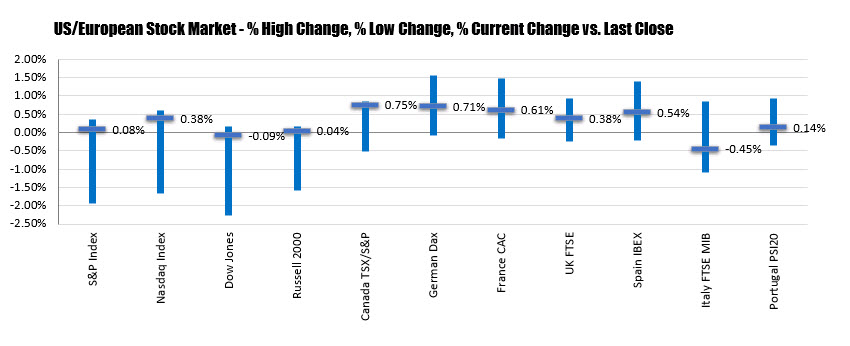

- European shares decouple from the US market. End mostly higher

- CNBC reports: Trump to ban government agencies from purchasing from Huawei

- China keeps door open for September talks - report

- Saudi Crown Prince sticking to $2 trillion valuation for renewed Aramco IPO -report

- US EIA weekly oil inventories +2385K vs -2700K expected

- Canada July Ivey PMI 54.2 vs 52.4 prior

- Gold trades at $1500 for the first time in over 6 years

- Goldman Sachs highlights "increasingly attractive" risk-reward in cable

- Trump says the problem isn't China, it's the Fed

- This is the sound of a central bank cutting 50 basis points

- The JPY is the strongest and the NZD is the weakest as NA traders enter for the day

- Spot gold, up $26.80 or 1.82% at $1501.08

- WTI crude oil is down -$1.28 or -2.38% at $52.36

- Spot silver is up $0.6620 or 4.03% at $17.112

The markets

went on a wild ride today the NY session through midday saw yields tumbling,

stocks tumbling, gold rallying, and oil crumbling, but then a later day rally

that reversed markets.

At the end of the day,

- The broader US indices ended with modest gains. That was no small feat given the Nasdaq was down -1.67% at the lows (ended up 0.38%) and the S&P was down as much as -1.95% (ended up 0.08%).

- Gold (as mentioned, reached as high at $1510 before coming back down a bit to $1501.08.

- Crude oil traded as low as $50.52 but rallied to $52.36 by the close.

What caused all the

volatility?

The markets continue to be reacting

to global worries about US/China.

That fear led to the RBNZ cutting

rates by a greater than expected 50 bps at the start of the day (25 was

expected). Later India and Thailand also cut rates as countries (in

general) seem to want to get ahead of the Fed in stimulating, and are happy to

"ask questions" later.

That in turn had Pres. Trump tweeting once again his displeasure with the Fed (of course throwing 10% tariffs and threats of 25% around does change the dynamics for the Fed and the economy but that goes unsaid). All of which did not help the yields and stocks. Both picked up steam to the downside.

Meanwhile in the forex market, it

had it's own related stories to trade off of.

For the EURUSD, the reaction lately

is if stocks falter, the EURUSD rallies (whats bad for the US is good for the

EU. I guess there is hopes that China deals more with the EU). That

helped to send the EURUSD pair above its 100 day MA at 1.12249 to a high of

1.1241.

The USDCAD moved higher on the back of the falling oil prices. The price of USDCAD moved above it's 100 day MA at 1.3300 to a high of 1.3343.

The NZDUSD tumbled on the back of

the rate decision early in the Asian sesson, but saw a rebound to the 50% of

the days range as the USD started to take on some heat (midpoint is at 0.6467

and that is where the price rally stalled).

The USDJPY traded below the low from yesterday (which was another new low going back to the flash crash on January 3rd) at 105.51, to a new low of 105.484. The market could not go any further.

The USDCHF tested the June low at

0.9693 level with the low reaching 0.96915, but could not go any further.

After London had left for the day,

there were comments from Fed's Evans with some dovish overtones.

Secretary of State Pompeo spoke with

UK's Raab about signing a trade agreement as soon as Brexit is figured

out.

Ironically a bad auction for 10 year

notes, helped to send yields higher and the market cheered the reversal of

yields

In the oil market, the Saudi's came

out with a few headlines saying that the price of oil falling is because of

fear and that they would be working with producers to get the price back

higher. That sent crude oil higher which appeased stocks as well.

As a result, in the forex:

- The EURUSD fell back below the 100 day MA at 1.1224 and headed back toward the 1.1200 level

- The USDCAD - on the rally back in oil - moved lower and tested the 100 and 200 day MAs at the 1.3300 level (down from 1.3343).

- The USDJPY and USDCHF each squeezed higher - helped by the fundamental stories and the fact that the breaks to new lows, could not gather additional downside momentum. The USDJPY moved from 105.49 to a NY afternoon high of 106.26 and the USDCHF moved from 0.9691 to 0.9753.

Now of course, what goes up can

easily go down again (and visa versa), but for now the market seems to have

dodged a meltdown in stocks, bond yields and crude oil. Tomorrow is a new

day....

Learn Bangla: Forex Bangla

News source

Tuesday, August 6, 2019

~~~Forex Bangla today: USD/CNY to fresh highs weighing on risk!~!

~~~Forex Bangla today: USD/CNY to fresh highs weighing on risk!~!

Volatility is here to stay. The VIX is at 24.59 +6.98 (39.64%) currently,

levels last seen at the turn of the year. Indeed, we are likely in for another

rough ride in Asia today, with the Japanese Nikkei is following suit in the

Tokyo open, opening down heavily while earlier news came with the US Treasury

officially calling out China as a currency manipulator.

"Defensive currencies outperformed and risky currencies underperformed the US dollar. EUR/USD rose from 1.1120 to 1.1210, the euro almost keeping up with traditional safe-haven Swiss franc (+0.9%). USD/JPY tumbled from 106.60 to a seven-month low of 105.79 in Tokyo trade Monday as the yuan fell but then consolidated in London and NY trade.

AUD/USD ranged in the mid-0.67s, preserving yesterday’s 0.5 cent fall on the CNY surprise. NZD remained above yesterday’s one-month low of 0.6489, firming to 0.6530. AUD/NZD extended a multi-month decline to 1.0342 – the lowest since March – with AUD hit harder by US-China trade tensions once again."

News source

- USD/CNY rallies to fresh highs and weighs on risk for Asia today.

- All eyes will be on the RBA and AUD/JPY will be a focus.

Forex overnight was ransacked by the

USD/CNY fixing above 6.90 which sent the Yuan above the 7 handle of which we

have seen an extension to fresh highs at 7.1399 in early Asia, so far. However,

the US Dollar dropped heavily as well as US yields fell, sinking to fresh lows

as US stocks turned into another rout, with the biggest drop in the S&P on

record and it would appear that the bears are not about to pack-up their picnic

and go home yet. Data was not pretty either, with the US ISM services

index fell to a three-year low of 53.7 in July, below expectations (55.7) -

However Markit’s July service sector PMI was upgraded to 53.0 from a

preliminary 52.2.

There is a growing sense that these

moves are only the beginning and that they have been entirely justified

considering the major implications for how bad things are under the surface of

zero interest rate supported economies, with central bank policies borne out of

the 2008 financial crisis now coming to a head with very little ammunition left

on the table to bail out the next recession - For the 2008 crisis was merely

patched up and was never really properly resolved.

· USD/CNH rallies to fresh highs as US Treasury calls China a currency manipulator

Currency action

Analysts at Westpac broke down the price action in the G10 space:"Defensive currencies outperformed and risky currencies underperformed the US dollar. EUR/USD rose from 1.1120 to 1.1210, the euro almost keeping up with traditional safe-haven Swiss franc (+0.9%). USD/JPY tumbled from 106.60 to a seven-month low of 105.79 in Tokyo trade Monday as the yuan fell but then consolidated in London and NY trade.

AUD/USD ranged in the mid-0.67s, preserving yesterday’s 0.5 cent fall on the CNY surprise. NZD remained above yesterday’s one-month low of 0.6489, firming to 0.6530. AUD/NZD extended a multi-month decline to 1.0342 – the lowest since March – with AUD hit harder by US-China trade tensions once again."

Key notes from Wall Street:

Wall Street ends in a sea of red on trade war re-set, biggest decline of the year for S&P 500Asia events today:

"Australia should print another historically large trade surplus in June (11:30am Syd/9:30am Sing/HK). Indeed Westpac forecasts a record high $A6.2bn surplus, driven by a spike in iron ore prices. This should help boost exports 0.8%mth, a gain limited by softer LNG volumes and lower coal prices. We see little change in imports on the month," analysts at Westpac explained.News source

Monday, August 5, 2019

***@Forex US Dollar Trade News@@@

Forex Bangla ***@Forex US Dollar Trade News@@@

Forex - U.S. Dollar Falls as Trade Tensions, Slowing Services Data Weigh

Forex2 hours ago (Aug 05, 2019 11:08AM ET)

© Reuters. © Reuters.

Investing.com - The U.S. dollar fell to an almost-two-week low after weak services data, while trade tensions between the U.S. and China prompted a selloff of the Chinese yuan.

The U.S. dollar index, which measures the greenback’s strength against a basket of six major currencies, fell 0.6% to 97.308 by 10:50 AM ET (14:50 GMT).

Growth in the services sector fell to its weakest level since August 2016, with trade worries weighing on business orders, the ISM non-manufacturing survey showed.

The greenback was already weak from tensions with China, as the government asked state-owned companies to stop buying American agricultural goods, Bloomberg reported. The move is in retaliation to U.S. President Donald Trump threatening fresh tariffs on essentially all Chinese goods.

The chances of a 50-basis-point rate cut in September rose on the news, with the odds above 20% compared with 2% at the end of last week. A quarter point cut of at least 25 basis points is already priced in.

The onshore yuan, which is controlled by the Chinese central bank, fell to an 11-year low below 7 to the dollar, indicating the Chinese were not supporting the currency. But it was labeled "currency manipulation" by President Donald Trump in a tweet.

The safe-haven Japanese yen was higher, with USD/JPY falling 0.5% to 106.01.

The euro rose due to the weakness in the greenback, with EUR/USD rising 0.8% to 1.1193. Sterling inched up due to upbeat PMI data earlier in the session, with GBP/USD rising 0.1% to 1.2168.

Elsewhere, USD/CAD fell 0.1% to 1.3194, while USD/MXN jumped 1.5% to 19.5841.

News source

Forex - U.S. Dollar Falls as Trade Tensions, Slowing Services Data Weigh

Forex2 hours ago (Aug 05, 2019 11:08AM ET)

© Reuters. © Reuters.

Investing.com - The U.S. dollar fell to an almost-two-week low after weak services data, while trade tensions between the U.S. and China prompted a selloff of the Chinese yuan.

The U.S. dollar index, which measures the greenback’s strength against a basket of six major currencies, fell 0.6% to 97.308 by 10:50 AM ET (14:50 GMT).

Growth in the services sector fell to its weakest level since August 2016, with trade worries weighing on business orders, the ISM non-manufacturing survey showed.

The greenback was already weak from tensions with China, as the government asked state-owned companies to stop buying American agricultural goods, Bloomberg reported. The move is in retaliation to U.S. President Donald Trump threatening fresh tariffs on essentially all Chinese goods.

The chances of a 50-basis-point rate cut in September rose on the news, with the odds above 20% compared with 2% at the end of last week. A quarter point cut of at least 25 basis points is already priced in.

The onshore yuan, which is controlled by the Chinese central bank, fell to an 11-year low below 7 to the dollar, indicating the Chinese were not supporting the currency. But it was labeled "currency manipulation" by President Donald Trump in a tweet.

The safe-haven Japanese yen was higher, with USD/JPY falling 0.5% to 106.01.

The euro rose due to the weakness in the greenback, with EUR/USD rising 0.8% to 1.1193. Sterling inched up due to upbeat PMI data earlier in the session, with GBP/USD rising 0.1% to 1.2168.

Elsewhere, USD/CAD fell 0.1% to 1.3194, while USD/MXN jumped 1.5% to 19.5841.

News source

Subscribe to:

Posts (Atom)